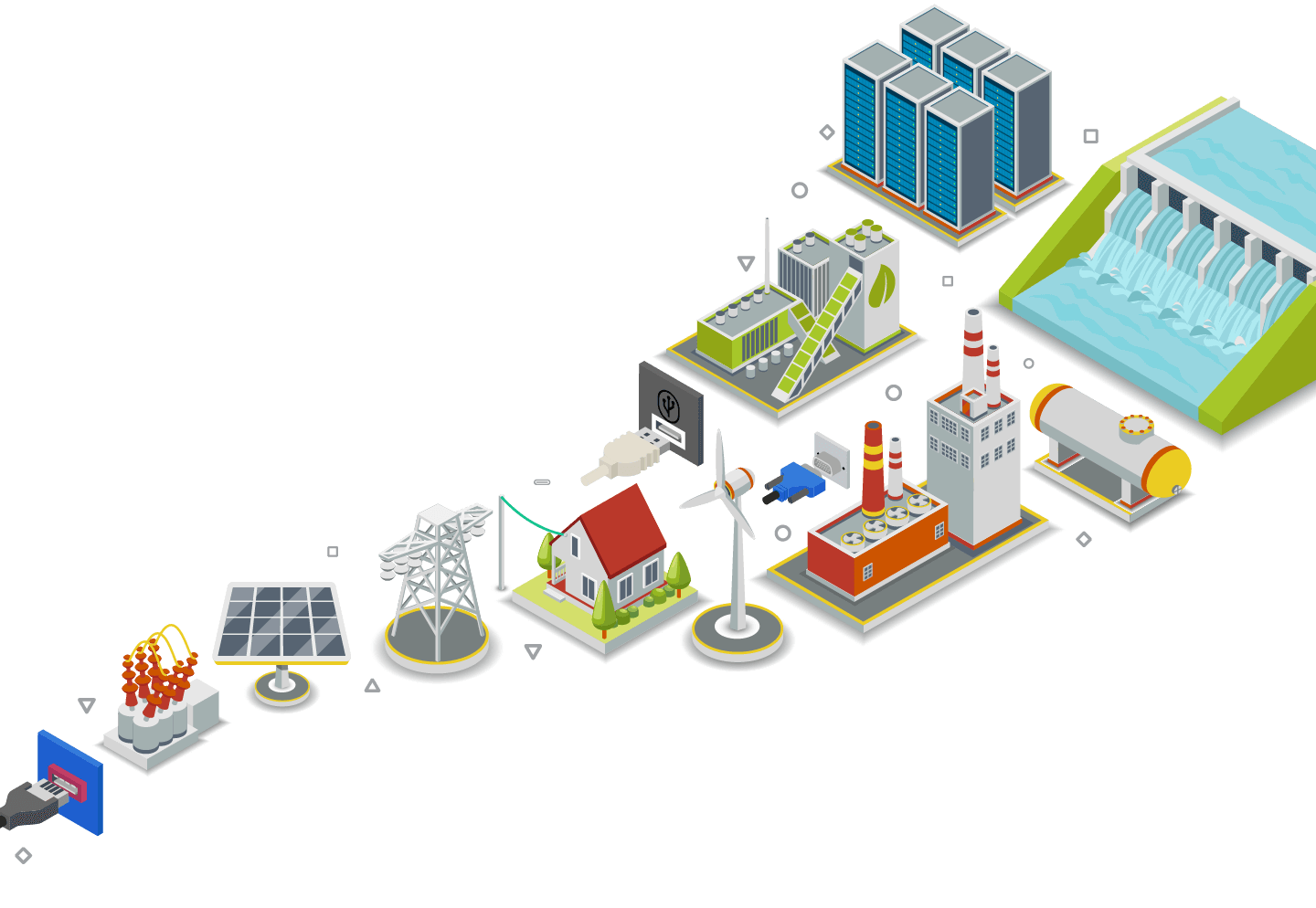

Hydrogen:

Saviour or illusion

Hydrogen’s allure is obvious. When burnt with pure oxygen it produces harmless water vapour, rather than carbon dioxide, with effectively zero greenhouse gas emissions.

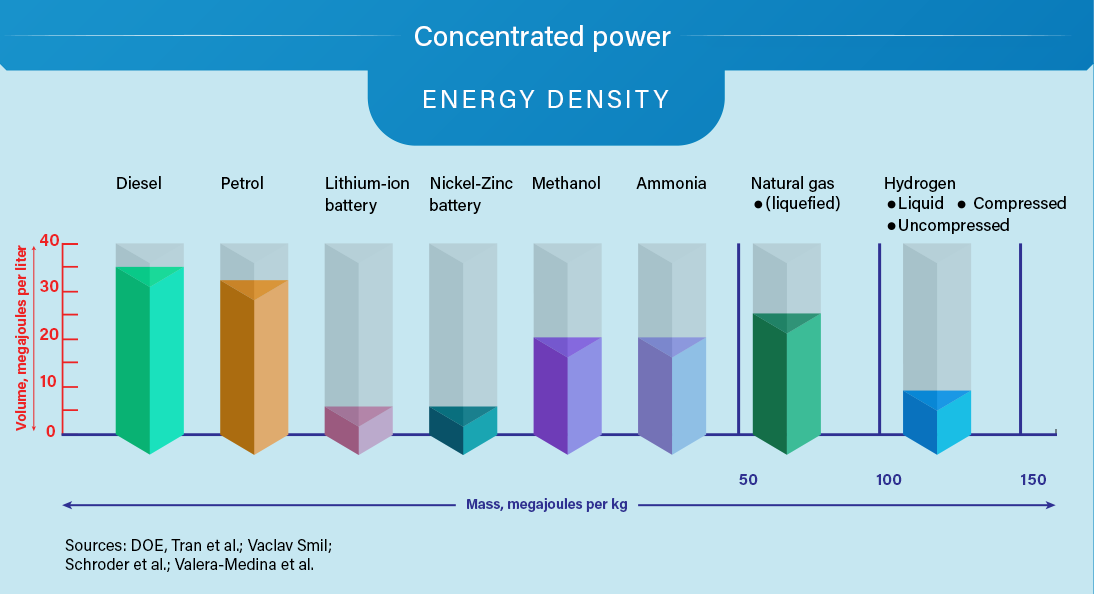

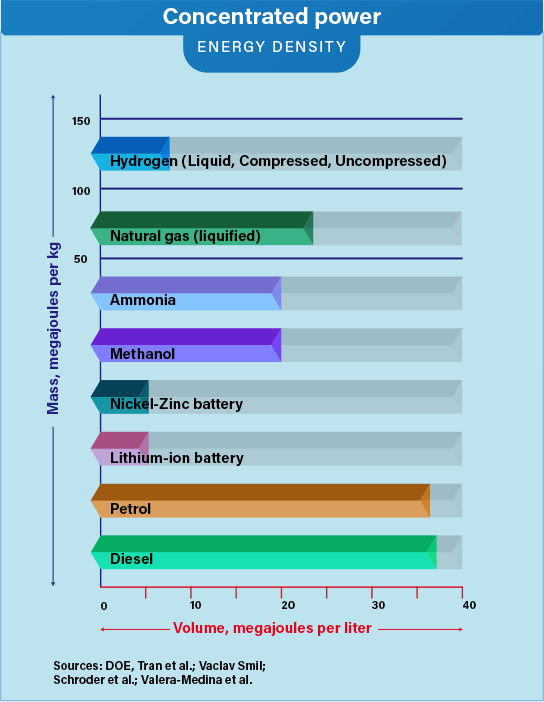

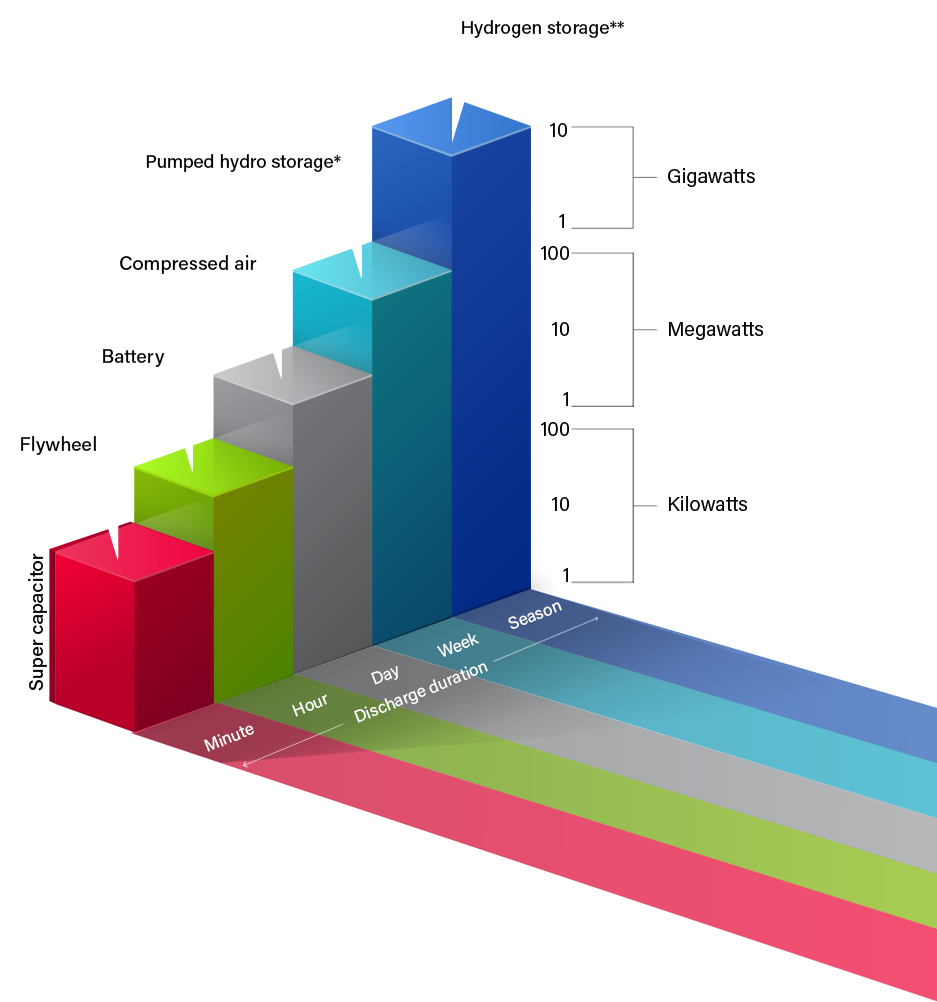

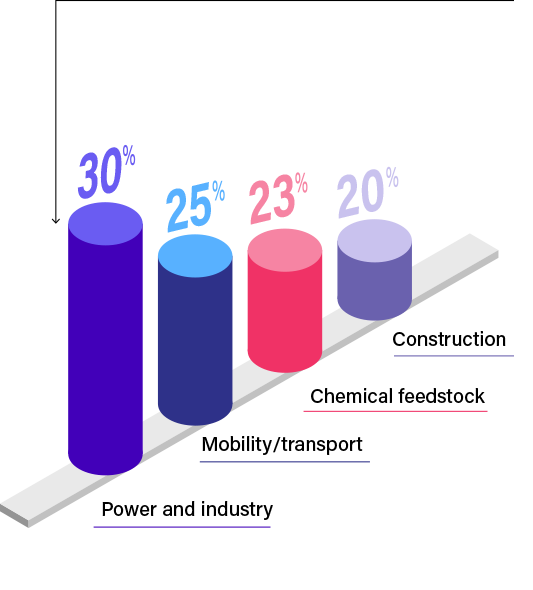

Its potential applications are also diverse. It provides much more energy per litre, or gram than electric batteries, making it an obvious candidate to power engines in planes, trains, cars and ships. It can also store energy giving it a potential role to play in power generation, and as a backup for intermittent supply from renewables such as solar and wind.

Hydrogen can be stored for months without losing much of its power

Technology overview, in power and time

* Limited storage (-1% of energy demand)

**As hydrogen or synthetic natural gas

Sources: Hydrogen Council; International Energy Agency

Hydrogen is also finding its way into heavy industry. Iron and steel production currently account for almost a quarter of all carbon dioxide emissions from industry. In Sweden a zero emissions alternative is currently being trialled, which would use clean burning hydrogen instead.

It is this combination of environmental sustainability and flexibility in application that is leading to forecasts of a surge in hydrogen usage, and pushing experimental hydrogen companies toward soaring valuations.

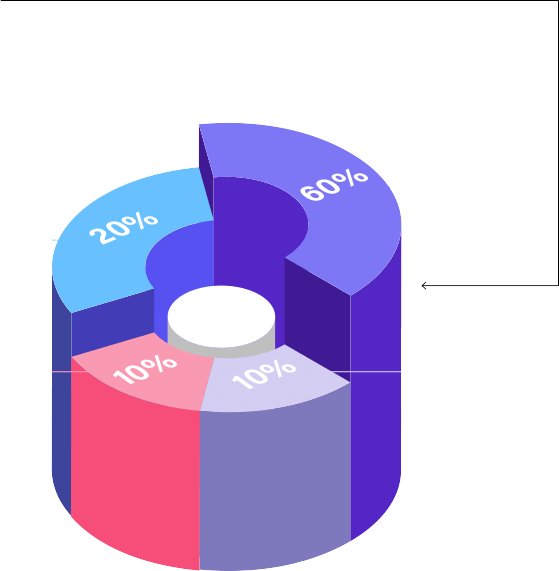

Source: Morgan Stanley

The $150bn global hydrogen market...

By use - 2020

……and its forecast $600bn future

By use - 2050

And its challenges

The problem is we have been here before, more than once. General Motors built its first hydrogen-powered vehicle in the 1960s. A decade earlier, at the start of the Cold War, the US Air Force government secretly built the world’s largest liquefied hydrogen plant north of Miami, as part of plans to develop a hydrogen fuelled plane.

Each time hydrogen has run up against problems of cost and complexity, which have made the gas difficult to commercialise as a fuel.

From an emissions perspective, not all hydrogen is born equal. Using it may not generate carbon dioxide, but in order to produce the gas, hydrogen molecules need to be isolated from the compounds in which they occur.

Currently most hydrogen is produced by reforming methane (CH4) at a high temperature, but this produces carbon dioxide as a byproduct. An emissions free method is electrolysis, where a current is passed through water (H2O) to separate hydrogen from oxygen. But unless the electricity comes from renewable sources there is, again, an environmental cost.

“Hydrogen is a clean fuel, but only if it's produced in a clean way and used in a clean way,” notes Mark Jacobson at Stanford University’s Woods Institute for the Environment.

In recent years, a lexicon of different types of hydrogen has been developed, each defined by the process used to produce it (and therefore, the level of emissions associated):

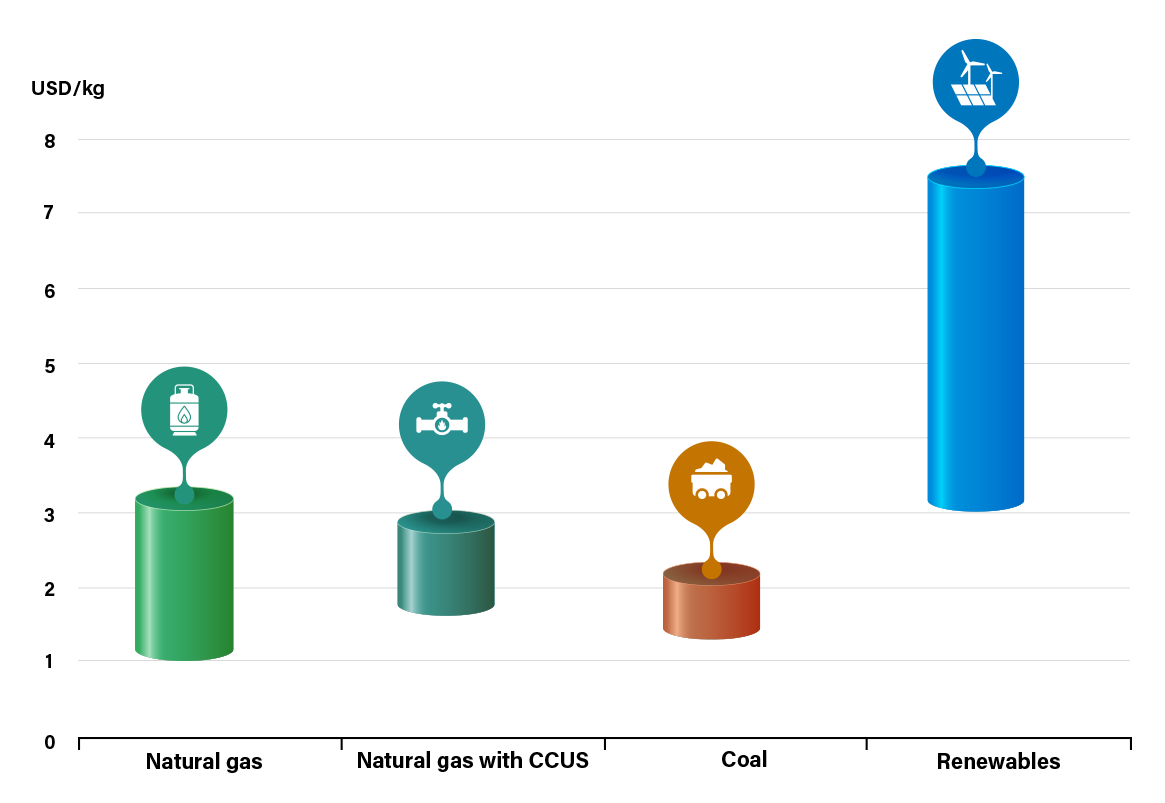

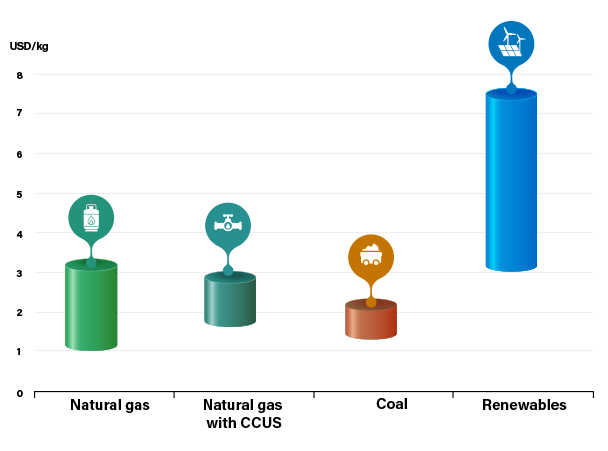

The crucial point is that “Green” hydrogen, produced by electricity generated from renewable energy sources, currently only accounts for about 1% of global hydrogen supply. For now at least, it is also by far the most expensive source of hydrogen although this may improve where renewable eletricity prices fall.

Hydrogen production costs by production source, 2018

Source: IEA

Costs are likely to fall, as electrolyser technology improves and is deployed at scale. But another concern is that hydrogen production could simply mean diverting renewable energy from other uses. Electrolysis is not particularly efficient either, resulting in an immediate energy loss of 30 percent.

One alternative is “Blue Hydrogen”, generated from methane as before, but in a way that allows the carbon dioxide produced to be captured, segregated and stored or put to use. Japan is betting big on CCUS, sponsoring projects in southern Australia to transform lignite (commonly known as ‘brown coal’) into hydrogen, while capturing the carbon dioxide emissions. The EU on the other hand has set out its stall in favour of green hydrogen.

Green hydrogen

Made by using clean electricity from renewable energy technologies to electrolyse water (H2O), separating the hydrogen atom within it from its molecular twin oxygen. Currently very expensive.

Blue hydrogen

Produced using natural gas but with carbon emissions being captured and stored, or reused. Negligible amounts in production due to a lack of capture projects.

Grey hydrogen

This is the most common form of hydrogen production. It comes from natural gas via steam methane reformation but without emissions capture.

Brown hydrogen

The cheapest way to make hydrogen but also the most environmentally damaging due to the use of thermal coal in the production process.

Turquoise hydrogen

Uses a process called methane pyrolysis to produce hydrogen and solid carbon. Not proven at scale. Concerns around methane leakage.

Beyond the source of the fuel, hydrogen faces challenges in common with other low emissions energy sources. In transport, for example, hydrogen takes up more space than diesel, or petrol, so requires larger tanks, impacting the economics, although it can be transported via pipeline much like natural gas. There is also no pre-existing network of charging stations.

The lack of an obvious path to commercialisation has seen some large companies lag governments in terms of enthusiasm for hydrogen fuel applications. France and Germany have pledged a combined €16bn to developing hydrogen technologies, but Volkswagen chief executive Herbert Diess recently poured cold water on the idea of hydrogen fuelled cars appearing even within a decade.

Turning hydrogen into a global fuel will also mean developing ship transportation. In southern Australia, Japanese and Australian companies are working together to liquify hydrogen, at temperatures of -253°C, so it can be loaded onto ships. Huge capital investments are required. Hydrogen can also be shipped by converting it to ammonia or binding it to a liquid organic hydrogen carrier, according to Professor Ad van Wijk.

Is this time different?

There is one simple reason to believe this time really may be different, and hydrogen could become mainstream despite the challenges. The argument starts from a simple premise: there is no alternative.

Past efforts to commercialise hydrogen have been driven by hopes for energy independence, or as a reaction to rising oil prices - incentives, in other words, that can easily slip away when geopolitical tensions subside.

This time around governments across the world have made long term commitments to substantial reductions in carbon dioxide emissions, which are unlikely to be shaken, given the existential threat posed by climate change. They are also putting their money behind the technology, with 15 governments and the EU announcing hydrogen plans last year, often including subsidies for the industry.

“2020 was really the year when counties formulated concrete ideas and strategies,” says Professor Ad van Wijk, at Delft University of Technology. That includes firm commitments to make hydrogen part of the energy mix. “After Fukushima, Japan has said ‘we will continue with nuclear but we also need another resource’.”

There are two dynamics at work, in other words: governments are showering money on an industry which is central to emissions targets, while incumbent companies dither on adopting a fuel that is currently uneconomic. The hope is that eventually government support will stimulate research which, combined with measures to tax CO2, could improve the economics.

A growing body of thinkers within the business world and among investors, is betting on exactly that, making decisions based on the assumption that emissions targets simply cannot be attained without hydrogen. Oil majors, such as Shell, for example, are beginning to invest heavily in electrolysers to produce green hydrogen.

We are also beginning to see the fruits of research in the shape of tangible technical innovations. In Germany, for example, researchers have found a way to store hydrogen as a paste. This could dispense of the need to super cool the gas to turn it into a liquid for transport, and provide a more convenient material to feed into fuel cells.

The technical challenges to deploying hydrogen as a fuel remain large. But the mobilisation of states across the world behind it is filtering down to company decision making, and offers the best chance yet of overcoming them.